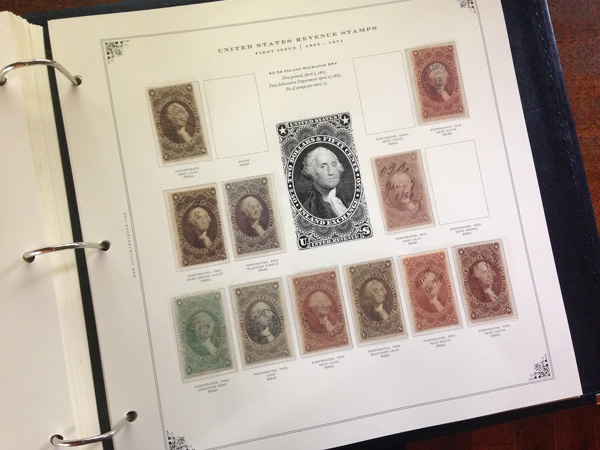

When The United States of America was a young country, the national government received most of its revenue from custom duties and property taxes. In 1862 the Treasury Department at the request of President Abraham Lincoln, planned a series of stamp (excise) taxes to help support the extraordinary cost of the Civil War. On July first of that year Congress passed the “Revenue Act of 1862″, authorizing the US government to collect taxes on:

- documents: deeds, insurance policies, checks

- consumer goods: matches, medicine, playing cards

- services: telegrams

- luxury items: liquor, beer, tobacco, perfume, photos

Not counting checks and stamped paper, over 7.8 billion revenue stamps were printed between 1862 and 1883, when the revenue act was repealed. Over two thirds of these stamps were privately printed under the authority of the government. In an attempt to reduce the manufacturing costs of the stamps, and at the urging of the peddlers of patent medicines, the government allowed the manufacturers – at their own expense (usually between $150 and $250) – to have dies engraved and plates made for their own exclusive use. After having them made the manufacturer would turn the plates over to the government, and whenever more stamps were needed the government would print for the manufacturer with the privately made plates. They also got free advertising and the appearance of government approval of their claims.

With an average face value of about 1.25 cents, nearly $65 million was raised.

“Match and Medicine” refers collectively to private stamps issued for the tax on:

- matches—183 different varieties

- medicines—350 different varieties

- perfumes—33 different varieties

- playing cards—16 different varieties

- canned fruit—one stamp

on up to 5 different types of paper.

Most were engraved to the high standards of postage stamps and bank notes.

The private stamps were first engraved and printed by Butler & Carpenter in Philadelphia. John Butler died in 1868 and Joseph Carpenter continued until 1875. The contract passed to the National Bank Note Company, the Continental Bank Note Company, and the American Bank Note Company. The Bureau of Printing and Engraving took over in 1881.

In 1882 the Revenue Act was repealed. However, having become attached to their individual revenue stamps because they were an excellent form of advertising, these manufacturers were reluctant to eliminate them. As a result facsimile labels resembling the original private-die stamps were created and used. The major difference in most cases was the elimination of the inscription “U.S. Internal Revenue”.

What makes so many of the M&M stamps rare?

- M&M stamps were never sold to the public

- They were placed on packaging and products, many times as seals, intentionally designed to be destroyed when the product was opened. As a result, faulty stamps are the norm. Perfect used stamps are the exception.

- The only saved stamps were those that were carefully removed by the buyer, or in some cases, remainders not used and sold to stamp dealers.

Stamp collecting was in it’s infancy, there were fewer people to save them.